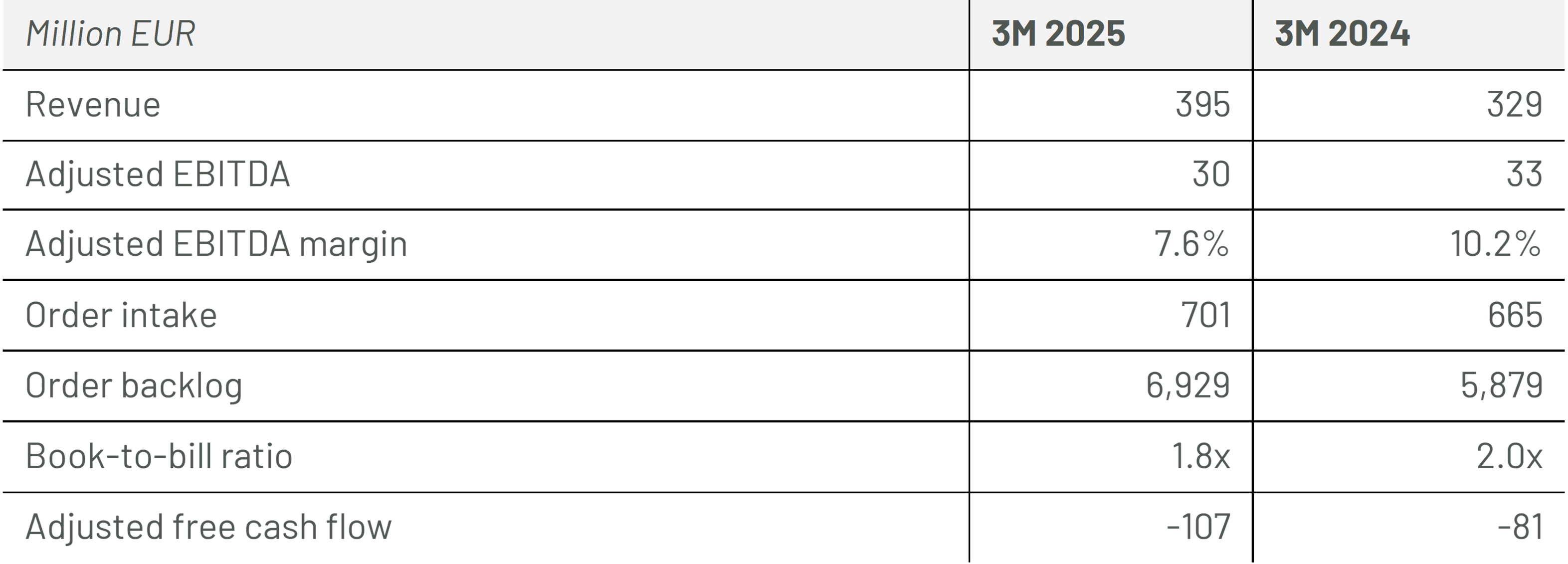

HENSOLDT reports strong first quarter 2025 with growth in order intake and revenue

- Order intake increases year-on-year to EUR 701 million

- Order backlog reaches new record level of EUR 6,929 million

- Revenue grows to EUR 395 million (previous year: EUR 329 million)

- Adjusted EBITDA at EUR 30 million (previous year: EUR 33 million)

- Financial restructuring successfully completed

- Guidance for the financial year 2025 confirmed in all key figures

The HENSOLDT Group ("HENSOLDT") has started the financial year 2025 with a strong result and remains on course for growth. The company achieved an order intake of EUR 701 million in the first quarter, once again exceeding the figure for the same period of the previous year (EUR 665 million). HENSOLDT benefited in particular from the contract extensions for the Eurofighter Mk1 radars and from orders under the Eurofighter Halcon programme. As a result, the order backlog again reached a record level and now stands at EUR 6,929 million. This corresponds to an increase of 4.3% compared to the end of 2024 and an increase of 18% compared to the previous year.

Revenues amounted to EUR 395 million, a significant increase on the same period last year (3M 2024: EUR 329 million). Alongside additional revenue from the ESG Group's business activities, this was mainly due to strong revenue growth in the Optronics segment. At EUR 30 million, adjusted EBITDA was slightly below the previous year's level (EUR 33 million).

Oliver Dörre, CEO of HENSOLDT, says: "The ongoing war in Ukraine and the conflict hotspots in the Middle East dominate the geopolitical agenda. These developments, as well as increased pressure from the US on its NATO allies to further increase defence spending, are leading to increased investment in military capabilities and technological sovereignty in Europe and Germany. At HENSOLDT, we have made targeted investments in the digitalization and connectivity of our products, in securing our supply chains and in our infrastructure and locations in recent years. As a result, we now have the technologies, solutions and operational capabilities to play a significant role in the upcoming German and EU procurement programmes and to increase our previous ambition of EUR 5 billion in revenue by 2030 to up to EUR 6 billion."

Christian Ladurner, CFO of HENSOLDT, assesses the financial results as follows: "In a dynamic political and economic environment, our operating business developed very robustly in the first three months of 2025. In terms of order intake, we once again exceeded the already very strong prior-year period once again and set a new record for the order backlog. This gives us excellent visibility for future business development. We therefore remain optimistic for the 2025 financial year and confirm our outlook for all relevant key figures."

Optronics segment with improved profitability

Revenue in the Optronics segment increased significantly by 34%. The strong sales performance of the European business thus continued. Adjusted EBITDA also improved noticeably compared to the same period of the previous year. This is mainly due to higher production volumes and progress in efficiency measures at the South African site.

The Sensors segment recorded an increase in both order intake and revenue compared to the same period of the previous year. Adjusted EBITDA declined slightly, mainly due to a slight decrease in productivity resulting from the commissioning of a new logistics centre. While this temporary lag effect is expected to be compensated during the year, the new logistics centre provides the basis for scalability and additional growth through warehouse automation and integrated data management solutions.

New financing structure successfully implemented

In April 2025, HENSOLDT successfully completed the realignment of its financing structure and replaced its previous financing with an unsecured, flexible corporate financing structure as part of a comprehensive refinancing. All conditions have been improved, the capital structure optimized, and a long-term stable interest burden ensured. The company has thus taken a decisive step towards even greater financial independence and entrepreneurial freedom.

Positive outlook for financial year 2025 confirmed

HENSOLDT expects the positive business development to continue in the financial year 2025 and confirms its guidance for all relevant key figures. The company anticipates revenue of EUR 2,500 to 2,600 million and a book-to-bill ratio of around 1.2x. Profitability will be reported as an adjusted EBITDA margin and is expected to be around 18%. Continued German and European investment in security and defence will result in further high demand for HENSOLDT's products and solutions.

Key figures

The HENSOLDT quarterly statement for the first three months of the financial year 2025 is available on the Investor Relations website of HENSOLDT AG. The financial results for the first half of 2025 will be published on 31 July 2025. The Annual General Meeting of HENSOLDT AG will be held in person on Tuesday, 27 May 2025 at the Wappenhalle in Munich.

Press contact

Joachim Schranzhofer

Our company

HENSOLDT is a leading company in the European defence industry with a global reach. Based in Taufkirchen near Munich, the company develops sensor solutions for defence and security applications. As a system integrator, HENSOLDT offers platform-independent, networked sensors. At the same time, the company is driving forward the development of defence electronics and optronics as a technology leader and investing in new solutions based on software-defined defence.

In addition, the company is expanding its range of offers to include new service models and is extending its portfolio of system solutions. In 2024, HENSOLDT achieved a turnover of 2.24 billion euros. Following the acquisition of ESG GmbH, the company employs around 9,000 people. HENSOLDT is listed on the Frankfurt Stock Exchange in the MDAX.

www.hensoldt.net

Download article images

Download the main image used in this article in different resolutions.Latest news